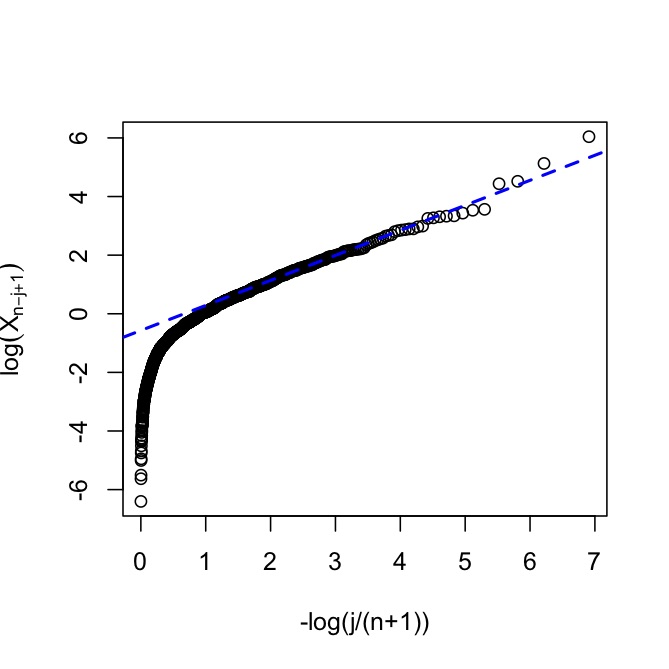

The depicted Pareto quantile–quantile plot offers a simple diagnostic device to detect distortions produced by standard rank-size regressions: If the city size / wealth /income distribution is Pareto-like, this plot will be linear for sufficiently high wealth.

The depicted Pareto quantile–quantile plot offers a simple diagnostic device to detect distortions produced by standard rank-size regressions: If the city size / wealth /income distribution is Pareto-like, this plot will be linear for sufficiently high wealth.

Abstract

City size distributions are not strictly Pareto, but upper tails are rather Pareto like (i.e. tails are regularly varying). We examine the properties of the tail exponent estimator obtained from ordinary least squares (OLS) rank size regressions (Zipf regressions for short), the most popular empirical strategy among urban economists. The estimator is then biased towards Zipf’s law in the leading class of distributions. The Pareto quantile–quantile plot is shown to offer a simple diagnostic device to detect such distortions and should be used in conjunction with the regression residuals to select the anchor point of the OLS regression in a data-dependent manner. Applying these updated methods to some well-known data sets for the largest cities, Zipf’s law is now rejected in several cases.